Effie Zahos is considered one of Australia’s main private finance commentators with greater than twenty years of expertise in shopper finance matters, together with banking, finance and property. She has a knack for making a living issues easy. Effie shares her high price range suggestions and monetary recommendation to get finance match with The Wholesome Mummy.

It’s by no means been a dearer time to dwell! With one other rate of interest rise for mortgage holders, a rental disaster and costly petrol, electrical energy and meals, it truly is a time for some sensible monetary high suggestions.

As the price of residing continues to rise, inflationary pressures are anticipated to persist for a while. Aussies at the moment are searching for methods to take again management. The excellent news is that with somewhat planning, you’ll be able to. Because the saying goes, ‘you’ll be able to’t management the wind, however you’ll be able to alter your sails.’ And the perfect instrument you’ve in terms of adjusting your sails is the common-or-garden family price range. No person actually teaches you the way to construct a price range not to mention handle one.

It’s anticipated that you simply simply know the way to do it. I really cowl the fundamentals of budgeting in my ebook From Converse to Louboutins: A Actual Lady’s Information to Cash. First, it’s worthwhile to look backwards earlier than you’ll be able to transfer ahead. Print out your on-line financial institution statements and spotlight your bills.

What you’re searching for right here is:

- Did you overspend in some classes?

- Do it’s worthwhile to evaluate a few of your family payments?

- Is your spending according to your objectives?

- Do you’ve too many discretionary “faucet and go” purchases?

This could provide you with a good suggestion as to the place your cash goes. From right here, you’ll have the ability to group your prices right into a formulation.

Set your formulation

There’s no scarcity of formulation that will help you handle your price range, together with paying your payments on time and having the ability to take these much-needed holidays. A preferred choice is the 70:20:10 plan. Right here’s the way it works. Divide your cash between:

- 70% for on a regular basis residing prices (hire or residence mortgage, transport, clothes, meals and utilities).

- 20% for saving (don’t skimp on financial savings)

- 10% for splurging.

Subsequent, arrange some buckets. As a substitute of lumping your “on a regular basis residing” bills right into a single bucket, as an illustration, open a number of buckets (accounts) and provides every of them a nickname. You may need one account for college charges, one other for family payments and so forth. The identical goes for financial savings. The 20% could be additional damaged down between financial savings buckets – 5% can go to your wet day bucket, 10% to your vacation bucket and 5% to the “get forward” bucket.

Utilizing buckets inside buckets makes it simpler to realize a number of objectives. You possibly can allocate a set sum to every bucket, observe your progress and fine-tune your price range for every goal. Select fee-free on-line financial savings accounts with a wholesome ongoing price slightly than a short-lived introductory price, and you may’t lose.

Can you chop prices?

Chances are high, there’s a handful of common payments gorging down your pay packet. Had been you responsible of including on a couple of too many streaming providers throughout lockdown? Perhaps you’ll be able to have a look at whether or not or not you will get a greater deal, or perhaps give a selected service the flick.

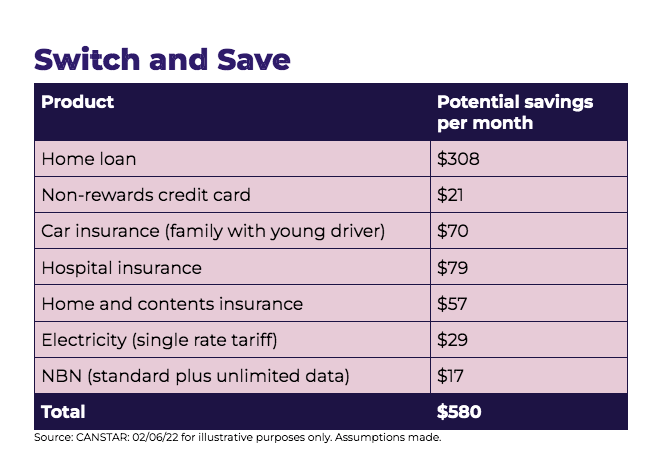

There are various easy steps you’ll be able to take to cut back your bills. Massive ticket gadgets like your house mortgage are the place the large financial savings are, however even small financial savings can add up.

Are you able to earn extra?

Don’t neglect your revenue. With regards to making further money, the sharing financial system affords loads of alternatives. You may resolve to hire out your spare room, share your automobile or pet-sit to spice up the cash coming in.

Love thy Tremendous

There’s a giant hole between the superannuation financial savings of Australian women and men. Given that ladies are likely to dwell longer it’s much more necessary for us to ensure we’ve a comfortable retirement. One option to learn how you’re monitoring is to make use of the net Tremendous Steadiness Detective on the SuperGuru web site.

Enter your date of beginning, and the calculator reveals how a lot you want in tremendous right now to achieve the ASFA Snug Customary stability by age 67. It reveals {that a} 35-year-old ought to presently have about $93,000 in tremendous.

In any other case, bounce onto the Retirement Planner on the MoneySmart web site. It reveals you’re doubtless revenue in retirement primarily based in your tremendous stability plus any Age Pension funds. Whichever choice you utilize, in case your stability appears somewhat lean, it’s by no means too late to develop your tremendous by means of wage sacrifice, voluntary contributions or authorities co-contributions. It could actually make an amazing distinction.

Let’s say a girl aged 35 earns $50,000 yearly and has the typical tremendous stability for a lady her age of $69,300. By including simply $1 further to her tremendous every day – that’s $30 a month, and she will be able to accumulate a further $148,389 in tremendous by age 67.

Head to Moneysmart’s on-line tremendous calculator to see how a couple of further {dollars} added to your tremendous could make a distinction.

There are methods you’ll be able to increase your tremendous even should you’re not working. Cashback websites like Tremendous-Rewards pay you cashback immediately into your tremendous fund simply by buying on their platform.

The best way to save $580 per 30 days

One of many best methods to claw again some financial savings is to try your common family payments – you would save as a lot as $580 per week by switching from common funds to the most affordable available in the market. While the most affordable might not at all times be the perfect it does provide you with a good suggestion of how a lot financial savings could be made by frequently reviewing your family payments.

Prime price range suggestions and cash guidelines to dwell by:

It’s not what you earn that counts; it’s what you spend!

If you get a pay rise, generally it’s a case of the extra you earn, the extra you spend, which then leads us to spend extra on services and products, in flip forcing us to earn much more. It’s a vicious cycle that almost all of us don’t even realise we’re in.

Detox your funds

Similar to an organised residence has a spot for all the things, so ought to each greenback you earn. The bucket system is a straightforward technique to assist tidy up your funds. There’s no scarcity of price range formulation to comply with, and a well-liked choice is the 70:20:10 plan. One other is the 60:40 price range plan.

Set your financial savings to autopilot

Pay your self first. Arrange common automated direct debits out of your on a regular basis account into your financial savings. Time the transfers to coincide with paydays. All the time deal with financial savings as a invoice – it can’t be missed!

Budgets aren’t set in stone

Some individuals don’t price range and are financially profitable, whereas others watch each cent but, due to their circumstances, proceed to dwell from pay to pay. When you’re going to do a price range, you’ve received to be trustworthy with your self about all these hairdresser appointments. There’s no level in making a price range that doesn’t mirror your life.

If you’ll comply with a price range, it’s necessary you’ve an emergency fund hooked up to it. In any other case, you set your self up for failure.

Work out what makes you tick

Why are some individuals higher savers than others? How do advertisers trick us with “mid-priced” choices? Understanding your monetary psychology may prevent cash. Take the time to seek out out why you do what you do.

Don’t spend mindlessly

Sleep on all impulse purchases for not less than one evening.

Determine your monetary stressors and make a plan

Strive to not overwhelm your self. Make an inventory of all the cash woes you’re having and give attention to managing one challenge at a time in order to not develop into overwhelmed.

Maintain collectors within the loop

Name your collectors if you’re experiencing monetary hardship and allow them to understand how you propose to sort out the problems. Many firms have hardship officers who can assess your state of affairs and work out what assist and technique is obtainable.

Construct a money cushion

A money cushion is finance strictly for emergencies solely. Assume the lack of a job, medical sickness or an sudden monetary curveball.

The concept is you come up with the money for in your cushion account to not solely deal with the disaster however, within the occasion of a job loss, cowl your absolute necessities (meals, shelter, clothes – designer footwear don’t depend) till you discover a job once more. It’s best to purpose to have a couple of thousand {dollars} in there to assist you thru this era.

It could actually take some time to construct up a cushion account, and when you’ve got a mortgage, it might pay to maintain your financial savings there. For instance, you’ve a $400,000 mortgage at 3.37%, and you may afford to save lots of $50 per week. Popping this into your house mortgage’s redraw or offset facility, you’ll not solely have $36,000 within the account after 15 years, however in line with Canstar evaluation, you’ll save round $10,700 in curiosity on your house mortgage.

Search assist

When you don’t know the place to start out, name the free Nationwide Debt Helpline on 1800 007 007. Nationwide Debt Helpline is a not-for-profit service that helps individuals sort out their debt issues. We’re not a lender, and we don’t ‘promote’ something or generate profits from you. Our skilled monetary counsellors provide a free, impartial and confidential service.

For extra nice household price range suggestions, try The Wholesome Mummy Price range Hub your go-to for budget-friendly suggestions, methods and affords from The Wholesome Mummy Price range Squad.