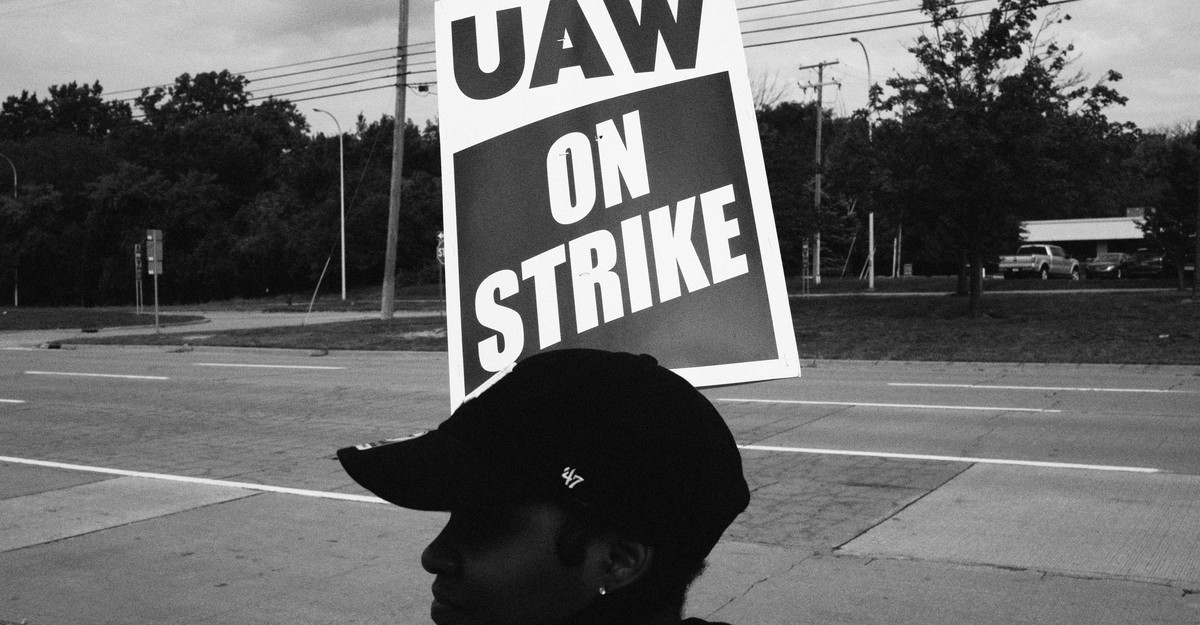

The United Auto Employees’ strike towards the Huge Three U.S. carmakers has given rise to lots of speak about the way forward for the auto business, and the destiny of autoworkers in a world of electrical autos. Republican politicians have tried to pin the autoworkers’ grievances on the Biden administration’s proposal for an electric-vehicle mandate (a proposal but to be adopted). Ford, GM, and Stellantis (which owns Chrysler), in the meantime, have warned that the UAW’s calls for may jeopardize their future EV investments.

The fact, although, is that this strike isn’t concerning the future. In an vital sense, it’s a battle over the previous. The UAW is wanting, in impact, to win again the concessions it made within the late 2000s, which basically reworked work on the Huge Three, whilst the businesses insist that they can’t afford to return to the way in which issues have been.

The UAW’s first spherical of concessions got here throughout contract negotiations in 2007, when the Huge Three have been dropping billions of {dollars} a 12 months, and watching opponents gobble up market share. The union agreed to let the businesses set up a two-tier wage system, which meant that beginning pay for employees employed after 2007 could be considerably decrease than it had been for present staff. New employees would even have much less beneficiant well being advantages, and wouldn’t get defined-benefit pensions or well being care as retirees.

Two years later, the monetary disaster and recession of 2008–09 almost put the Huge Three out of enterprise altogether (and did drive GM and Chrysler into chapter 11), whereas excessive unemployment diminished no matter leverage the union had. So, as a part of the federal government bailout of GM and Chrysler, the UAW agreed to additional concessions designed to slim the labor-cost hole between the Huge Three and their worldwide opponents (whose vegetation within the U.S. are all nonunion). The union additionally agreed to not strike for the subsequent six years. Older employees have been supplied buyouts, enabling the businesses to herald youthful (and cheaper) employees. And computerized cost-of-living wage will increase have been suspended.

Over the 14 years that adopted, the UAW received small wage will increase in contract negotiations, and smoothed the trail for employees employed after 2007 to achieve top-tier standing. Even so, the premier wage right now—about $32 an hour—is value significantly much less, in actual phrases, than it was in 2003, whereas new employees start at roughly $17 an hour (which is concerning the beginning wage at my native Goal). And, largely as a result of older employees make up a declining share of the general workforce on the Huge Three, autoworkers’ common actual hourly earnings have fallen nearly 20 % since 2008, in line with the left-leaning Financial Coverage Institute.

The UAW needs to alter all that. It’s on the lookout for a 40 % across-the-board pay enhance over the subsequent 4 years, a restoration of cost-of-living will increase, and enhanced pensions and retiree well being take care of all autoworkers. And the union’s not stopping there: It’s additionally demanding that autoworkers get a 32-hour workweek (whereas nonetheless being paid for 40 hours). The UAW is asking, in different phrases, for one thing like a return to the pre-financial-crisis discount, plus somewhat extra.

The UAW’s president, Shawn Fain, has acknowledged that these calls for are “formidable.” However tight labor markets have given unions extra leverage than previously—as evidenced by the Teamsters just lately successful a 48 % pay enhance over 5 years for part-time employees at UPS, and the American Airways pilots’ union gaining a greater than 46 % pay enhance over 4 years for its members. And the UAW’s technique for the strike—which has up to now concerned walkouts at solely three factories, with the specter of escalating the motion to different vegetation if no deal is reached—has up to now minimized the financial prices of the dispute for its members.

Nonetheless, few observers count on the union to get the automakers to return to something just like the outdated established order, notably relating to pensions and retiree advantages. That’s as a result of—regardless of a latest return to profitability—the previous decade has been dismal not just for labor on the Huge Three, but in addition for capital.

Which will sound inconceivable. In spite of everything, Ford, Chrysler, and GM now have a lot decrease labor prices, due to a mix of downsizing, their better reliance on entry-level employees, and automation. The hole between the Huge Three’s hourly-wage prices and people of their nonunion rivals, equivalent to Toyota and Honda, has narrowed dramatically. (Estimates recommend that the discrepancy now stands at about $9 to $12 an hour, largely due to the price of paying for retirees.) And the automakers have made hefty earnings over the previous decade: Ford posted a 34 % enhance for the reason that final spherical of contract talks, in 2019; GM realized a 50 % bounce over the identical interval (comparable figures for Chrysler are laborious to return by, as a result of it’s a single firm inside the Stellantis conglomerate, which additionally consists of Jeep and Dodge). The Huge Three have additionally spent billions on share buybacks and dividends.

These earnings, although, haven’t translated into any actual advantages for shareholders. Even with the buybacks, the annual return on GM’s shares since 2013, together with dividends, has been simply 1.9 %, whereas Ford’s has been simply 1.5 %. (Stellantis inventory has accomplished higher, although, once more, Chrysler’s affect on that’s laborious to find out.) The S&P 500, in contrast, has risen by a median of greater than 10 % a 12 months over that interval, and simply shopping for a 10-year authorities bond would have given you a greater return than investing in Ford or GM inventory.

Higher administration on the Huge Three has accomplished very effectively over this era, because the UAW repeatedly factors out. GM’s CEO bought a wage package deal final 12 months valued at almost $29 million; Ford’s CEO bought one value nearly $21 million. Because the UAW’s Fain put it throughout a Fb look in August, “Whereas Huge Three execs have used these excessive earnings to pump up their pay, our members have fallen additional and additional behind.” This appears unlikely to be a convincing argument to shareholders who’ve seen their investments in GM and Ford go nearly nowhere.

Stagnant inventory costs are usually not the fault of employees; neither is it the UAW’s job to fret about shareholder pursuits. So the union is correct to be utilizing this second when it has most leverage to attempt to get all it will probably. (That’s very true on condition that nobody is aware of what the transition to electrical autos will imply for the UAW, whose grasp settlement with the Huge Three doesn’t cowl their battery-cell factories.)

Arguably, the union has the better message to promote to the general public, although it’s going to most likely want greater than that to maneuver the automakers. A great compromise is one which leaves either side sad, runs the maxim, however the hassle right here is that either side are already sad. That’s why discovering a compromise may take longer, and inflict extra financial ache, than anybody needs.